Why is Payment Gateway Integration Essential for Your Business?

Payment gateway integration is set up as a payment method and verified front-end side eCommerce website accepts digital payments from the customers. Payment Gateway Integration is essential for your business because it facilitatessecure online transactions, enhances customer experience, ensures compliance with regulations, and supports business growth in the digital economy.

Whether you’re an eCommerce service provider or a leading software testing company, integrating a payment gateway is critical to streamlining financial transactions with clients efficiently.This can ensure prompt invoicing and secure payment processing, building trust and professionalism in business interactions. By offering a range of payment options through a reliable gateway, the company can cater to a diverse global clientele and maintainoperational agility. This integration not only enhances client satisfaction but also reinforces the company's reputation for reliability and seamless service delivery in the competitive software testing industry.

Table of Contents

- Why is Payment gateway authentication necessary for eCommerce website and what are its different types?

- Types of Payment gateway verification

- Payment getaway HTTP Response Codes

- Payment getaway Error Response Codes

- Conclusion

Why is Payment gateway authentication necessary for eCommerce website and what are its different types?

A payment getaway is required for eCommerce website because of its part of Security, Fraud Prevention, Risk Mitigation, Enhanced User Experience, Compliance with Industry Standards purpose.

- Here are the types of Payment gateway authentication that follows a common factor utilized in eCommerce websites.

- 3D Secure (3DS)

- Tokenization

- Biometric Authentication

- Multi-factor Authentication (MFA)

- One-time Passwords (OTP)

- Device Authentication

- Risk-based Authentication

Types of Payment gateway verification

- Success: The gateway requests successful paid payment.

- Decline:The call to the gateway was completed successfully, but the payment gateway declined the payment. This response often happens when the customer has insufficient funds to complete the transaction.

- Validation: Customer payment data is incorrect, such a misspelling in the credit card address or incorrect CVV.

- Permanent Fail: The gateway calls failed, and future requests using the same payment method won't work. This response often happens when the external gateway or customer bank detects risk, such as attempted fraud. If you receive this response, don’t make further payments using the related payment method. The customer must contact their bank to review the issue that prompted the Permanent Fail response.

- Requires Review:The customer bank requires additional information before completing the payment.

- Indeterminate: Billing didn’t receive any response from the gateway. This response usually happens when Salesforce Billing times out waiting for the response. This response doesn’t increase the payment run’s failure count.

- System Fail: Billing ended the payment request call before receiving a response. For example, billing lost credentials or lost access to its server then this response increases the payment run’s failure count. It ends payment calls if it doesn’t receive a response from the gateway in two minutes.

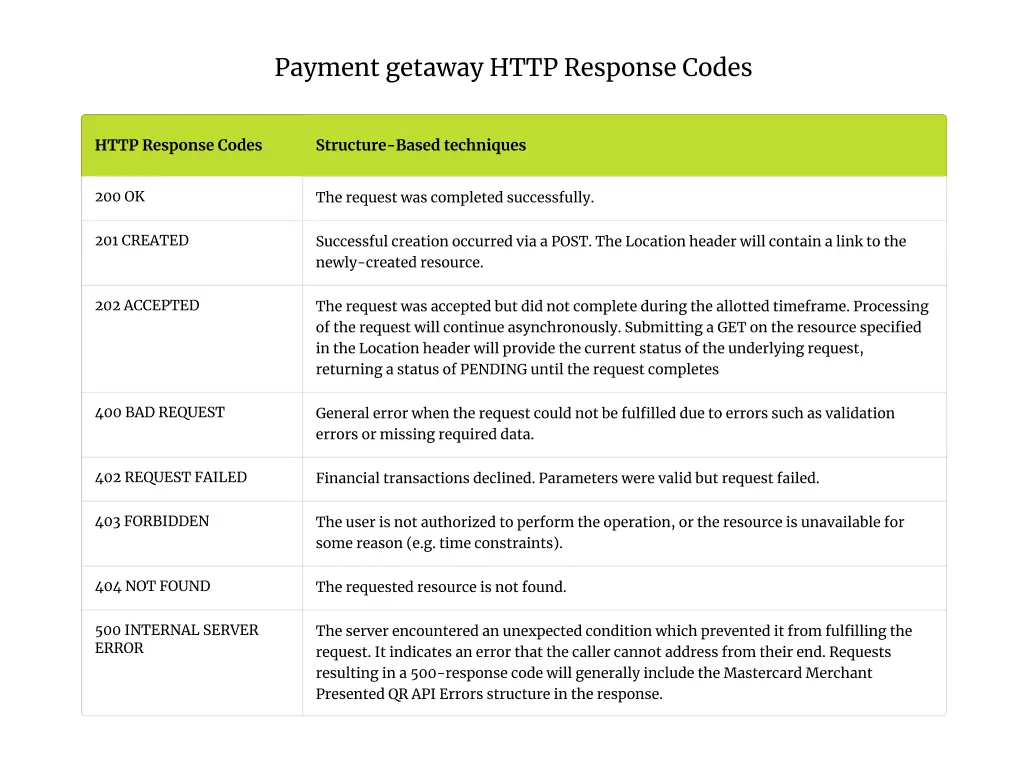

Payment getaway HTTP Response Codes

Transaction response code processed API requests will result in response messages with HTTP code. Majorly below some response code are verify by the tester.

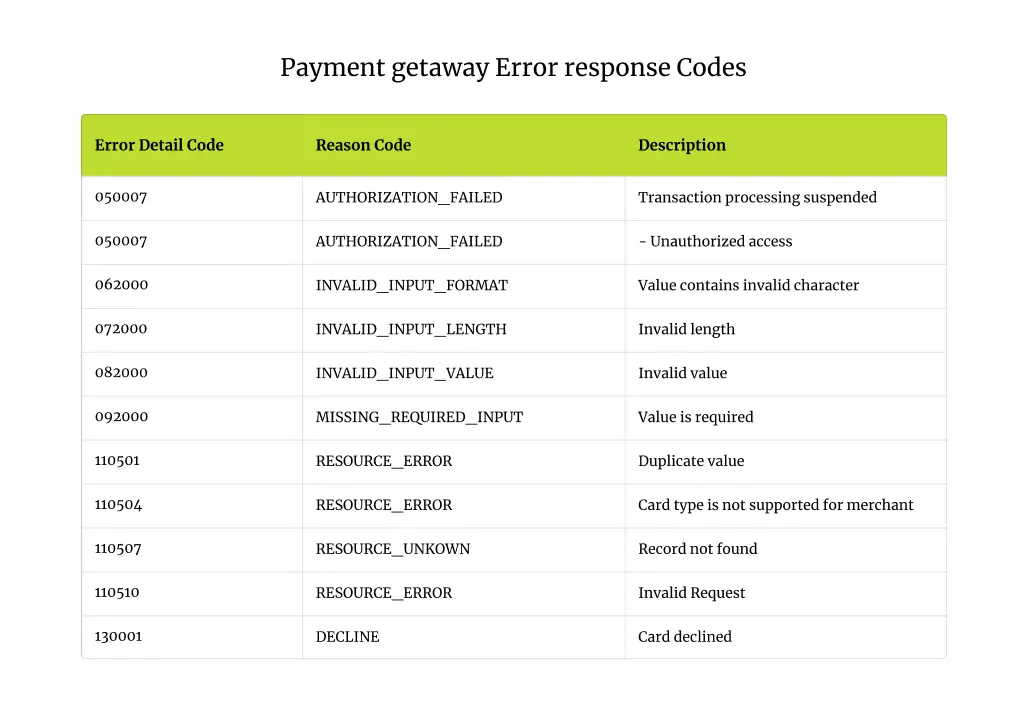

Payment getaway Error Response Codes

Transaction error response code getting an error form the server-side response from the payment getaway side. Majorly below some error codes are verify by the tester.

Conclusion

Without a doubt, payment gateway integration is essential for modern businesses looking to optimize their online sales. Companies may guarantee simple and secure financial transactions by integrating a dependable payment gateway, which improves the client experience overall. This integration is essential for keeping compliance with strict industry regulations about financial transactions, in addition to making the process of receiving payments online easier. Companies that put payment gateway integration first show that they care about customer pleasure and operational efficiency, which in turn builds client loyalty and trust.

After reading this post, you must have known that integrating a payment gateway is crucial for a reliable eCommerce development company to ensure secure and efficient online transactions. It enhances customer trust by offering diverse payment options and adhering to strict security standards like PCI compliance. A well-integrated gateway also streamlines the checkout process, reducing cart abandonment and maximizing conversion rates. Overall, it plays a pivotal role in delivering a smooth and trustworthy customer shopping experience, which is essential for sustainable business growth.

About Author

Mayur Rathod is an experienced IT professional, currently holding the role of QA Manager at The One Technologies from last 10 Year. His journey in IT began in April 2014, and since then, he has made significant strides from a junior role to achieving a managerial position through dedication and skill development. He aspires to specialize in database testing and automation using Python, aiming to contribute innovative solutions to enhance software development processes.

Mayur Rathod is an experienced IT professional, currently holding the role of QA Manager at The One Technologies from last 10 Year. His journey in IT began in April 2014, and since then, he has made significant strides from a junior role to achieving a managerial position through dedication and skill development. He aspires to specialize in database testing and automation using Python, aiming to contribute innovative solutions to enhance software development processes.