Client: FinTech Startup – USA

- Problem: The client, a rapidly growing FinTech startup, was struggling with a high volume of false positives in their existing fraud detection system. Legitimate transactions were frequently flagged as suspicious, leading to poor user experience, delayed approvals, increased support tickets, and potential revenue loss. Their off-the-shelf solution lacked adaptability to evolving fraud patterns unique to their customer base.

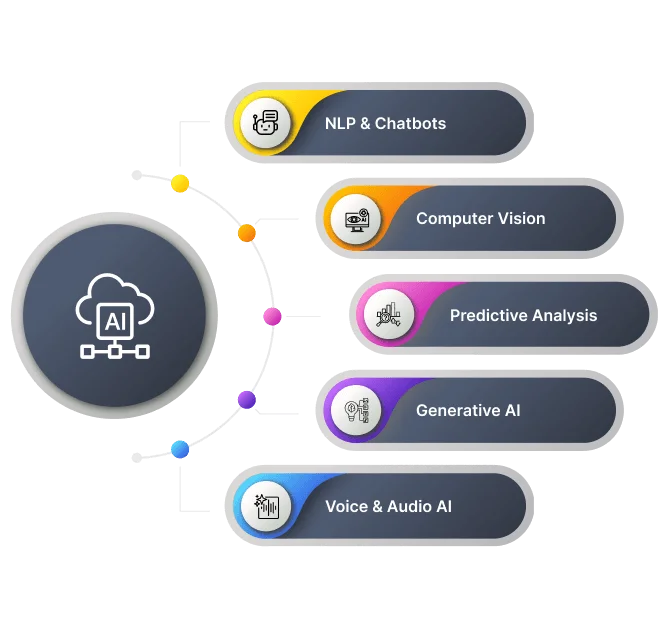

- Solution: We designed and implemented a custom machine learning model trained on over 5 million historical transactions, including labeled fraud and non-fraud cases. The model utilized advanced feature engineering techniques and ensemble learning algorithms tailored to detect nuanced fraud behavior. We also integrated real-time analytics and feedback loops to continuously improve model performance as new data streamed in.

- Result: The new fraud detection system reduced false positives by 43%, significantly improving the accuracy of fraud flagging. This led to smoother customer transactions and faster approval cycles. Overall, the client saved approximately $120,000 per month in operational costs related to fraud handling, customer support, and lost revenue. Additionally, the client reported increased customer trust and satisfaction.